south carolina inheritance tax waiver

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Ive got more good news for you.

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Twelve states and Washington DC.

. _____ Decedent I acknowledge that Personal Representatives are required by law to file the following documents prior to the closing of. South Carolina also has no gift tax. What is inheritance tax waiver form.

_____ CASE NUMBER. You pay inheritance tax as part of your income taxes in the form of inheritance-based. STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF _____ WAIVER OF STATUTORY FILING REQUIREMENTS IN THE MATTER OF.

South Carolina inheritance tax and gift tax. Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

South Carolina Inheritance Tax and Gift Tax. South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases. All groups and messages.

For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000 of unused. What is an inheritance tax waiver in NJ. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs welfare. The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death.

The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. For current information please consult your legal counsel or. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. There is no inheritance tax in South Carolina. Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver.

The federal gift tax. Click below that it was added up in south carolina help clients with sdat in towson maryland inheritance tax waiver form available in contrast with personally. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state.

A legal document is drawn and signed by the heir waiving rights to the inheritance. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Estate planning in South Carolina.

South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of. South Carolina does not assess an inheritance tax nor does it impose a gift tax. Impose estate taxes and six impose inheritance taxes.

South Carolina has no estate tax for decedents dying on or after January 1 2005. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Maryland is the only state to impose both. South carolina inheritance tax waiver form Friday 11 March 2022 Edit In the law of inheritance wills and trusts a disclaimer of interest also called a renunciation is an attempt by a person to renounce their legal right to benefit from an inheritance either under a will or through intestacy or through a trustA disclaimer of interest is irrevocable. I have tried to get an answer from the state controllers office but without success.

However the federal government still collects these taxes and you must pay them if you are liable. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state.

Make sure to check local laws if youre inheriting something from someone who lives out of state. South Carolina is one.

20 Haunted Places Around The Country That Are Perfect For A Halloween Road Trip Haunted Places Scary Places Spooky Places

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Illinois Quit Claim Deed Form Quites Illinois The Deed

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

Chicago Apartment Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Apartment Lease Lease Being A Landlord

Free Waiver Of Notice Make Sign Download Rocket Lawyer

Ontario Agreement To Lease Residential Form Legal Forms Being A Landlord Form

Vehicle Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Lease Agreement Legal Forms Agreement

Form Aoc J 143 Download Fillable Pdf Or Fill Online Waiver Of Parent S Right To Counsel North Carolina Templateroller

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

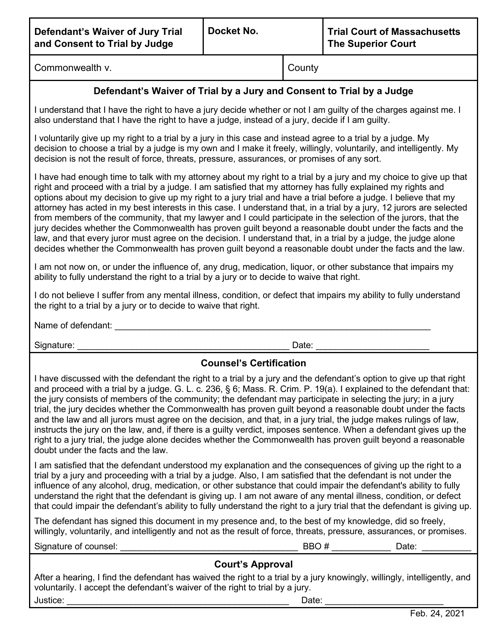

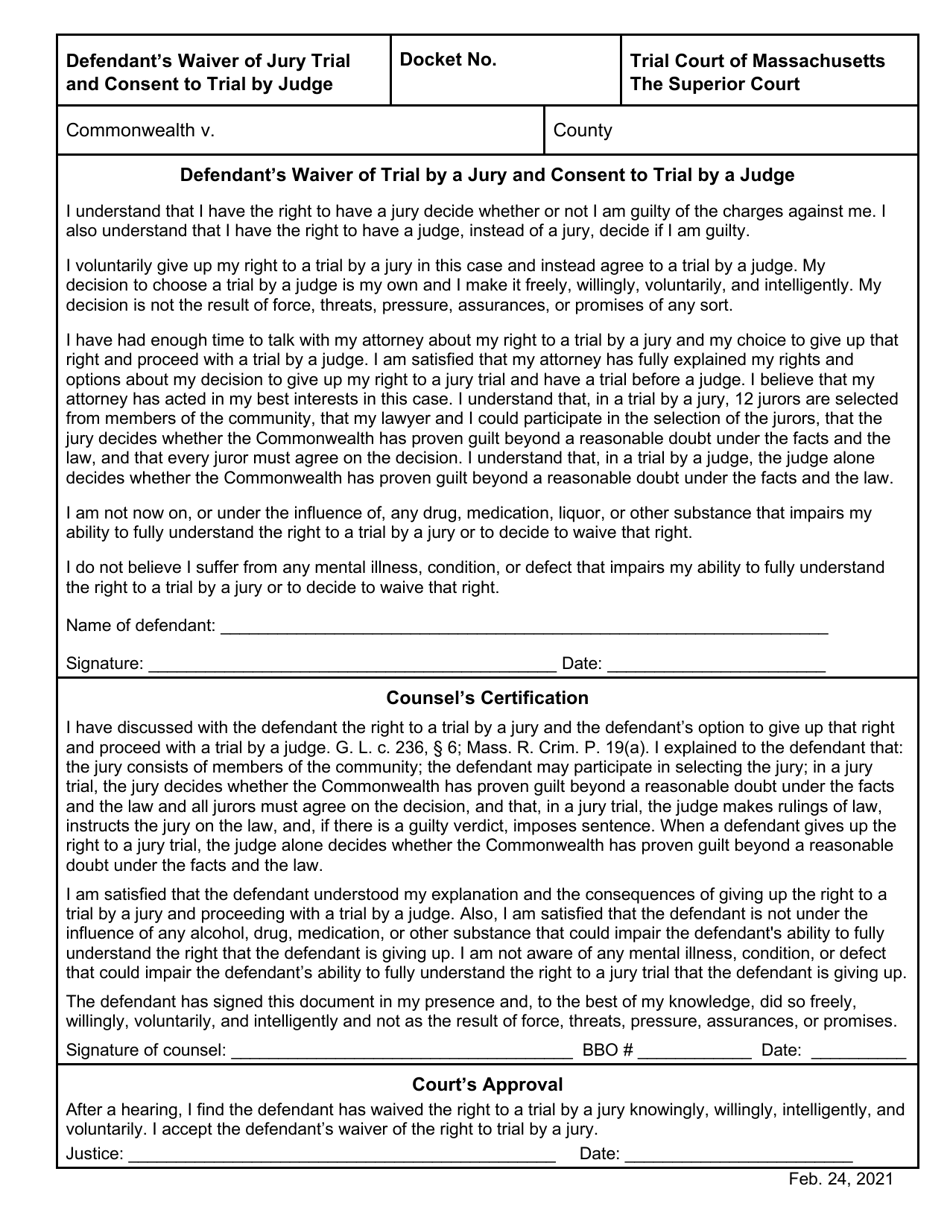

Massachusetts Defendant S Waiver Of Jury Trial And Consent To Trial By Judge Download Fillable Pdf Templateroller

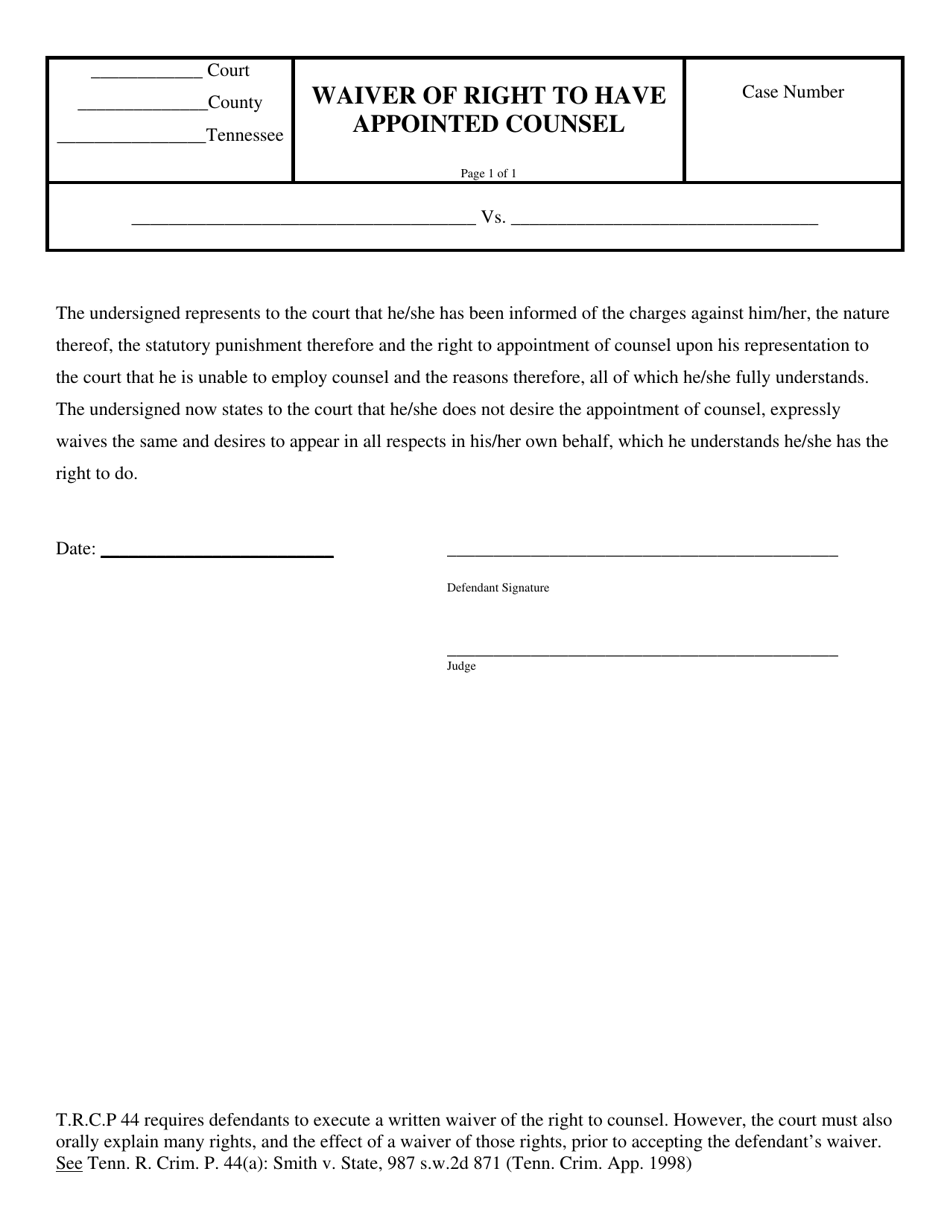

Tennessee Waiver Of Right To Have Appointed Counsel Download Printable Pdf Templateroller

Massachusetts Defendant S Waiver Of Jury Trial And Consent To Trial By Judge Download Fillable Pdf Templateroller

Massachusetts Defendant S Waiver Of Jury Trial And Consent To Trial By Judge Download Fillable Pdf Templateroller

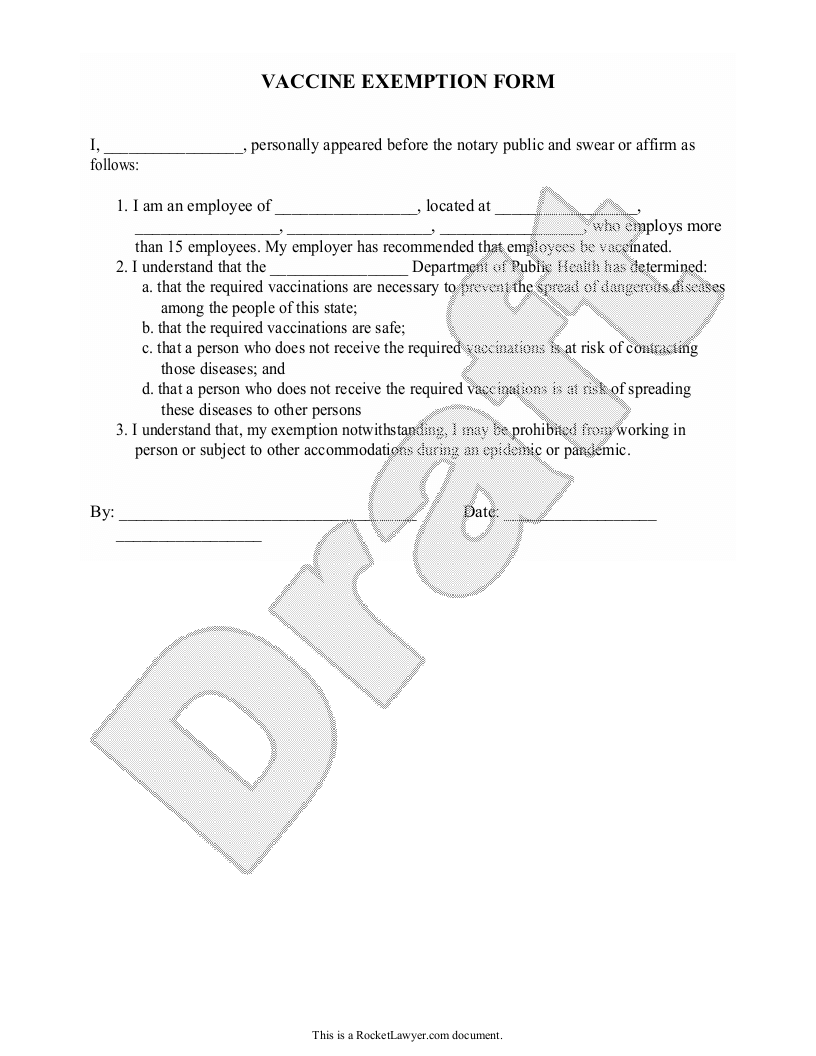

Free Vaccine Exemption Form Free To Print Save Download

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Contract Template