salt tax cap married filing jointly

The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. You will not be able to claim 10000 each if you.

Homeownership Taxes 2021 Edition

For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT.

. Is this the same number for single married filing jointly and married filing singly. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status. In the 2017 Tax Cuts and Jobs Act the federal government enacted a 10000 limit for joint and individual filers and a 5000 limit for married couples filing separately.

For married couples filing separately the SALT deduction limit is 5000 per return. New tax law for 2018. Hello Its my first time filing a joint return for 2019 year.

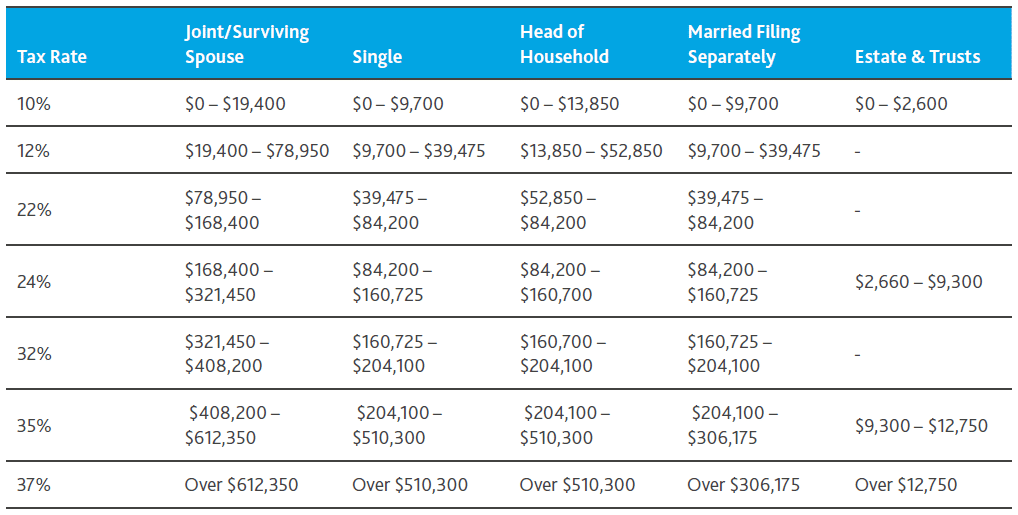

The limit is 5000 if. Your 2021 Tax Bracket To See Whats Been Adjusted. Under tcja the salt deduction was.

Ad Compare Your 2022 Tax Bracket vs. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. By limiting the SALT deduction.

Is it 5000 for Married Filing Separately. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers.

Your Family Can Live With a 30000 SALT Deduction Cap A compromise plan thats basically fair to everyone especially couples. Married couples filing jointly. Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed.

It is 5000 for married taxpayers filing separately. Nothing is certain but work and taxes. In December 2017 the then-GOP controlled Congress capped this longstanding deduction at 10000 for individual taxpayers and married couples filing jointly and 5000 for.

For example if you are a person with a Single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions. Second it would adjust the cap for. Trying to figure out how much of our 2018 state refund.

T he state and local tax SALT. Discover Helpful Information And Resources On Taxes From AARP. New tax law for 2018.

If both you and your spouse are 65 or older you. For married taxpayers filing separately the cap is 5000. For all other filing statuses the limit is 10000.

The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate return and 10000 for all other tax filers. My partner and I each received 1099gs in a high tax state. 11 rows Two single filers may each take up to 10000 in SALT deductions but jointly filing means.

52 rows The deduction has a cap of 5000 if your filing status is married filing. First it would raise the cap from 10000 10000 for married couples filing jointly to 15000 30000 married couples filing jointly. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

Salt cap of 10000. Head of a household. Head of household filers and married taxpayers filing jointly.

If you are Married Filing Jointly and you or your spouse is 65 or older you may increase your standard deduction by 1300. Tax reform limits the amount you can deduct from your federal taxes to 10000 5000 if youre married filing separately for all state and local taxes combined. The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers who.

Single taxpayers and married couples filing separately 6350.

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

Red Flags That Could Trigger An Irs Audit Marcum Llp Accountants And Advisors

2019 Year End Tax Planning Individuals Ohio Tax Firm

Charities Lobbying To Restore Expanded Tax Deduction For Giving Roll Call

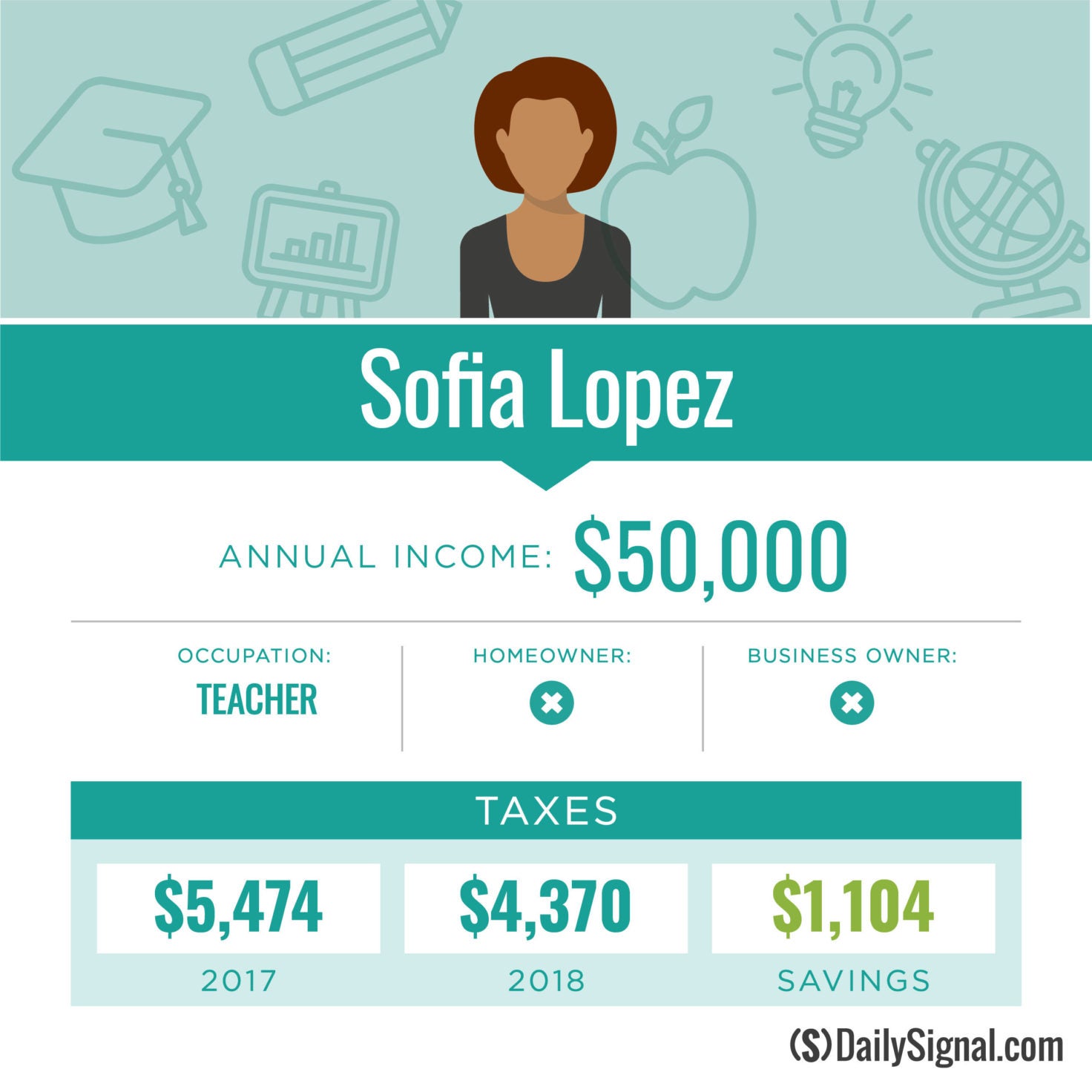

The Truth About How Much Americans Are Paying In Taxes The Heritage Foundation

Check In On The Sales Tax Deduction For 2018 Credit Karma Tax

12 Common Tax Write Offs You Can Deduct From Your Taxes Forbes Advisor

Biden Tax Plan And 2020 Year End Planning Opportunities

Tax Breaks You Can Claim Without Itemizing Smartasset

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

When Are Llc Members Subject To Self Employment Tax Ssf

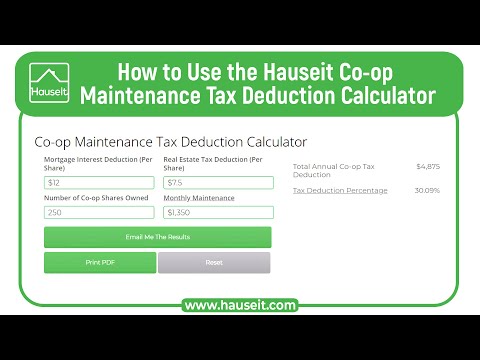

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

Income Tax Withholding My Nc Retirement

F 1 International Student Tax Return Filing A Full Guide 2022

Tax Benefits For Homeowners Homeowner Tax Deductions

Virginia State Taxes 2022 Tax Season Forbes Advisor